Secondary Markets

The general principle of the sale of life insurance policies on the secondary market has been internationally known for many years – in Great Britain since 1844, in the USA since 1911.

The German secondary market for life insurance is relatively young in comparison. Only since 1999 consumers have the option to sell their endowment or pension insurance policies to professional purchasers.

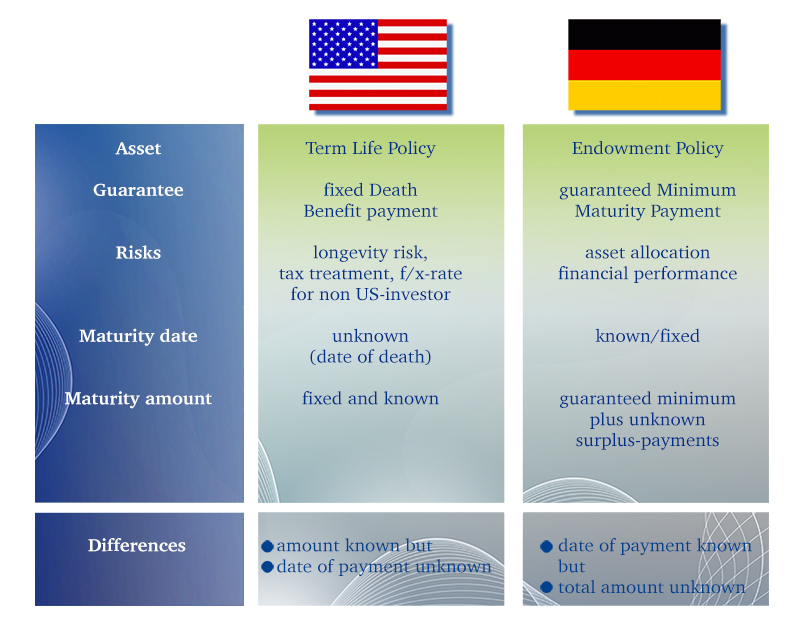

The basic features of these different secondary life insurance markets are shown in the following:

The secondary life insurance markets in the US and in Germany are clearly on the rise after the turbulences of the worldwide financial crisis in 2007/08. Especially because of the continuous efforts by the BVZL and other industry associations to increase consumer awareness and education, more and more policy holders use the life insurance secondary markets as a smart alternative on their financial planning and decision making. At the same time, more and more professional and institutional investors discover the purchase of tradeable life insurance policies as an attractive alternative investment opportunity.